State Council issues action plan for promoting high-level opening-up to attract foreign investment

State Council issues action plan for promoting high-level opening-up to attract foreign investment

State Council issues action plan for promoting high-level opening-up to attract foreign investment

The China Securities Regulatory Commission (CSRC), the country's top securities regulator, issued on Friday four policy documents to enhance supervision and management of the capital market and prevent risks, vowing to promote the high-quality development of the stock market.

The documents, which will strengthen scrutiny over stock listings, public companies and brokerages, demonstrated China's determination to protect investors with "teeth and horns" and boost market confidence, as well as cultivate a good environment for the healthy and stable development of the capital market, analysts said.

The prompt move, which came just days after the two sessions concluded, showcased the country's institutional advantage of efficiency in policymaking and implementation, and is also a vital part of China's accelerated efforts to build itself into a financial powerhouse, they noted.

Stepped-up efforts

Among the four documents, three are guidelines aimed to boost supervision of initial public offerings (IPOs), listed companies, brokers and public offering funds. The last one aims to enhance self-construction of the CSRC system.

Noting these four documents, Li Chao, vice chairman of the CSRC, said on Friday that the goal is to make China's capital market "safe, regulated, transparent, open, dynamic and resilient."

In order to improve the quality of listed companies at source, the CSRC will tighten supervision on initial public offerings (IPOs), preventing companies from excessive financing, while accounting fraud and false statements will be severely punished, Li said, while briefing the four documents.

In addition, it will adopt necessary adjustments in the IPO market, taking into account supply and demand in the secondary market, and will also enhance onsite inspections of listing candidates, said the official.

Moreover, regulators will strengthen scrutiny of listed companies, focusing on helping listed enterprises improve investment value and enhance investor protection. The CSRC will ramp up its crackdown on accounting fraud and illegal reducing of holdings, urging listed companies to increase dividend payouts and encouraging them to buy back shares, Li said.

"The key point of these four documents is to strictly vet the IPO applications, and the quality of listed companies, as these two parts are fundamental to enhancing the management of the capital market," Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at the Renmin University of China, told the Global Times on Friday.

IPOs are like the first button of the stock market system, and should be fastened properly from the beginning, Dong noted, adding that the listing of a company is based on what it needs for development and what it can supply, and a company that does not have the ability to continue to innovate and develop, or to continue to supply dividends, should not be listed.

Yang Delong, chief economist at the Shenzhen-based First Seafront Fund Management Co, said that these rules are specific and targeted solutions to some of the problems that previously existed in listed companies, and are important for improving the investability of the A-share market and promoting the long-term healthy development of the market.

"These measures will effectively improve the quality of listed companies and protect the interests of small and medium-sized investors, thereby boosting market confidence," Yang told the Global Times on Friday.

According to the documents, the CSRC will also strengthen regulations on securities firms and public offering funds, in a bid to promote its functioning, professional service capacity and regulatory effectiveness. It will crack down on wrongdoings by shareholders that go against the interests of institutions and investors, warning against money worship, extravagance, hedonism and showing off of wealth.

Yang noted that the above-mentioned moves showed the regulator's determination to build an investor-centered capital market, and correcting bad conducts will promote good professional practices in the industry, further boosting the healthy development of the securities and funds sector.

The securities watchdog also released a guideline to improve its own capabilities. Strengthening self-construction is an important guarantee for the CSRC to fully carry out its main responsibility for supervision and promote the high-quality development of the capital market, Li said, citing the document.

Dong noted that China is the second largest economy in the world and needs a strong stock market that matches the size of the economy, and a fair system and strong regulations are the key.

Path to financial powerhouse

The CSRC's move is a new part of an array of market-friendly measures to pave the way for long-term, high-quality growth in China's capital market.

During the just-concluded two sessions this year, China stressed in its 2024 Government Work Report that the underlying stability of the capital market should be enhanced.

Wu Qing, head of the CSRC, on March 6 said in his first public appearance before media since taking his new post that enhancing institutional buildup and attracting long-term investment into the market will be among the measures that will be taken to accomplish the task outlined in the Government Work Report.

Wu reiterated the importance of prioritizing investors, combating financial fraud, and encouraging listed companies to engage in cash dividends and buybacks.

In order to promote the sound development of the capital market and protect investors' rights and interests, the CSRC has held symposiums to solicit opinions and suggestions on improving the basic system of the capital market, strengthening the protection of the rule of law, and has also paid visits to listed firms to help them address difficulties in achieving high-quality development.

Since Wu took office on February 7, the Chinese A-share market has recovered much of its losses from the recent cycle, with the benchmark Shanghai Composite Index up 0.54 percent to 3,054.64 points and the Shenzhen Component Index closing 0.6 percent higher at 9,612.75 points on Friday.

As "finance" was mentioned 21 times in the 2024 Government Work Report, experts noted that in the new year, China will accelerate efforts to build itself into a financial powerhouse, and the stability of the capital market will contribute to the high-quality development of its financial sector.

The EU’s recent decision to maintain the anti-dumping measures targeting certain iron goods from China is a form of protectionism, a Chinese expert said on Tuesday, while urging the EU to provide a transparent and fair market environment for all goods from China.

The EU recently issued a commission implementation regulation imposing a definitive anti-dumping duty on imports of certain iron articles originating in China following an expiry review.

The measures have been effective as they helped to reduce the volume of Chinese imports in the EU market, but the volume of imports remained significant during the period, according to the EU.

Repeal of the measures would result in a significant increase of dumped imports from China at injurious price levels and would further aggravate the injury suffered by EU industry and threaten its viability, according to a document released by the EU. Therefore, the EU Commission concluded that maintaining the anti-dumping measures against China was in the interests of EU industry, the document said.

The EU's anti-dumping measures against Chinese iron and steel-related products have a very long time span, which reflects the international competitiveness of the Chinese products, Yang Chengyu, an associate research fellow at the Institute of European Studies of the Chinese Academy of Social Sciences, told the Global Times on Tuesday.

While the EU has often claimed that the "cheap" prices of Chinese products harm the fair competition and interests of local EU companies, Yang said that this claim is not really valid under the multilateral trading mechanism of the World Trade Organization.

The EU has intensified its economic coercion targeting Chinese-related products, which shows its protectionist mindset, Yang said.

On December 10, 2016, the European Commission announced the launch of an anti-dumping investigation into cast iron products originating in or imported from China and India. On January 30, 2018, the European Commission issued an announcement regarding a final affirmative anti-dumping ruling on cast iron products originating in or imported from China, according to mysteel.com.

The EU has long adopted various trade restrictions on imported steel products, including the widely criticized global steel safeguard measures that have been implemented for several years, as well as more than 60 anti-dumping and countervailing measures against steel products from many countries and regions, He Yadong, a spokesperson for China's Ministry of Commerce told a regular press conference on October 12, 2023.

These measures disrupt the international trade order, push up downstream production costs, affect the interests of consumers, and are not conducive to the stability of the global industrial chain and supply chain, He said, and nor are they conducive to the long-term development of local industries and the healthy operation of the market.

As a US bill that could potentially ban the use of TikTok in the US sailed unanimously through a House committee, Chinese experts said that the act is political gamesmanship by politicians playing the China-bashing card and yet another hysterical move in its crackdown against Chinese companies.

With bilateral ties showing signs of stabilization amid enhanced engagements between the two sides, Chinese analysts warned that the cyber witch hunt against TikTok - used by roughly 170 million Americans - and sheer extortion of a successful company will have negative effects and cause bilateral ties to retract.

The bill, which threatens to ban TikTok from app stores operated by Apple and Google unless the popular short video platform divests itself from ByteDance, its parent company, within about six months, passed unanimously out of the US House energy and commerce committee on Thursday with a vote of 50 to 0.

The bill is set for a floor vote next week.

US media outlet CNN described the bill as the "most aggressive legislation" targeting TikTok to come out of a congressional committee since company CEO Shou Zi Chew testified to lawmakers last year that the app poses no threat to Americans in a grueling hearing.

Chinese observers said the passing of the TikTok bill demonstrated a persistent campaign by some US politicians to hunt down the social media platform, which has enjoyed worldwide success, and is set to dent stabilizing ties between the two countries. Cooperation is the only sensible way forward in the field of science and technology, they noted.

"Some people in the US want to relate TikTok with China, threatening to impose further bans on the company. In the US presidential election year, some lawmakers aim to be tough on China regarding the sensitive and significant issue of TikTok, in order to demonstrate their commitment to so-called national security threats," Song Guoyou, deputy director of the Center for American Studies, Fudan University, told the Global Times.

Although the bill has only been passed within a committee of lawmakers and needs to go further through the legal pipeline, it nonetheless reflects a bipartisan consensus among some politicians in the US on this issue, Song said, noting that whether the bill can gain more support through legislative procedures needs to be watched closely.

"The bill demonstrated the obstinate political prejudice held by some US politicians against the influential platform," Li Yong, a senior research fellow from the China Association of International Trade, told the Global Times on Friday.

Last year, a federal judge temporarily blocked a statewide ban on TikTok in Montana, citing First Amendment rights.

Unable to provide any evidence, these politicians resorted to baseless fearmongering, Li said, refuting the claims that the app could present an espionage threat, as claimed by US politicians.

Driven by their sinophobic paranoia, some US politicians are pushing for a series of absurd bills, measures and bans on Chinese products or China-related goods.

In addition to the witch hunt against TikTok, which can be dated back to the Trump era, cargo cranes, automobiles and even garlic were among the targets US politicians raised red flags against in recent months.

US Commerce Secretary Gina Raimondo said in a recent interview with US media outlet MSNBC that "cars these days are like an iPhone on wheels… Imagine a world with 3 million Chinese vehicles on the roads of America, and Beijing can turn them off at the same time."

In a rebuttal to these false narratives, Hua Chunying, China's Foreign Ministry spokesperson, asked, "Were you suggesting that iPhones, Tesla and even Boeing… have been sending secret data back to the US and could be shut down at any time by Washington?"

Expressing their disagreement with the bill, TikTok users in the US are flooding the congress will telephone calls, with some staffers saying there are as many as 20 calls per minute, according to a report by The Guardian on Friday.

US social organizations such as the American Civil Liberties Union have slammed the bill as "unconstitutional." The Computer and Communications Industry Association, a major trade group representing tech powerhouses including Apple and Google, was also against it.

The move came amid enhanced engagements between Chinese and US officials and business organizations pointing to stabilizing ties, which help alleviate growing concerns among businesses and governments around the world.

The US and China have reportedly agreed to extend a science and technology agreement for another six months.

Chinese analysts said the two countries stand to benefit from cooperation on science and technology, and the ruthless crackdown on Chinese companies can only serve to undermine trust and damage stabilizing bilateral ties.

The renewal of the US-China Science, Tech Pact will be a test of how willing the Biden administration truly is to consider mutual interests, listen to the scientific community's voice and jointly maintain the stability of China-US relations, Song said.

A TikTok spokesperson told the Global Times on Wednesday that "this bill is an outright ban of TikTok, no matter how much the authors try to disguise it. This legislation will trample on the First Amendment rights of 170 million Americans and deprive 5 million small businesses of a platform they rely on to grow and create jobs."

Chinese Foreign Ministry spokesperson Mao Ning said on Friday that China believes ties with the US are not a zero-sum game and is opposed to defining ties by competition.

Ning Jizhe, a member of the standing committee of the 14th National Committee of the Chinese People's Political Consultative Conference (CPPCC) and the former chief of the National Bureau of Statistics, expressed his confidence in China achieving the GDP growth target of about 5 percent this year, while dismissing hype about the Chinese economy entering a recession.

Ning, who is also the deputy director of the Economic Affairs Committee of the CPPCC National Committee, made the remarks in an exclusive interview with the Global Times on Wednesday.

China has set its 2024 GDP growth target at about 5 percent, according to the Government Work Report submitted on Tuesday to the national legislature for deliberation.

Setting a goal of achieving around 5 percent GDP growth requires a proactive approach as it will involve hard work, overcoming obstacles and challenges. However, with determination and perseverance, this goal can be successfully achieved, Ning said.

Ning said that his confidence comes from China's huge market, complete industrial system and push for technological innovation. The unstoppable trend of globalization and the new wave of technological revolution also offer favorable conditions for China's development.

Ning noted that an economic growth target of around 5 percent effectively refutes negative narratives about the Chinese economy.

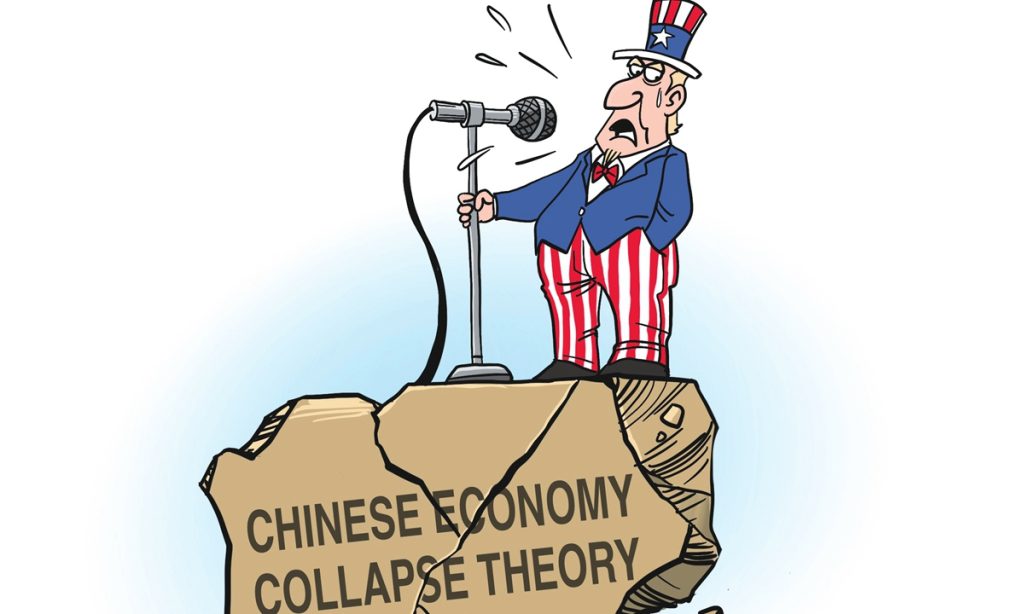

The "China economic recession" theory has been circulating for decades and it resurfaces whenever China faces key development challenges. However, facts have proven that every time, China has overcome difficulties through reform, opening-up and transformation, Ning said.

Ning highlighted China's resilience in the face of past economic challenges, such as the Asian financial crisis in the late 1990s and the global financial crisis in 2008, and he expressed optimism in China's ability to navigate challenges.

"Despite the challenges, China is currently in a phase of transitioning growth drivers, changing development modes and optimizing its economic structure. I am confident that we can achieve a GDP growth target of about 5 percent this year," Ning said.

He also dismissed claims that China's economy has peaked. "This is not only an unscientific judgment, but also a malicious attempt to discredit China. Among those who hold this view, some are ignorant of the situation," Ning said.

Ning emphasized that although China's per capita GDP reached about $12,700 in 2023, it is still the world's largest developing country, with significant room for development and potential for further growth.

The GDP growth target of about 5 percent was set based on scientific reasoning and aligns with the long-term development goals laid out in the 14th Five-Year Plan (2021-25). This is a target that can be achieved through utmost endeavor, Zheng Shanjie, head of the National Development and Reform Commission, China's top economic planner, said at a press conference on Wednesday.

The favorable conditions for China's economic development this year are stronger than the unfavorable factors, and China's economic rebound will be further consolidated and strengthened, Zheng said.

Zheng noted that China will expand macro regulation this year. Incremental policies such as large-scale equipment upgrades, trade-ins for consumer goods, and the issuance of ultra-long special-purpose treasury bonds will be implemented to support economic stability.

Positive momentum in the economy emerged in the first two months of this year, with indicators such as electricity consumption and consumer spending showing strong growth, paving the way for growth in the first quarter.

Industrial electricity usage expanded by 9.7 percent in the first two months of 2024, while the number of domestic tourist trips during the Spring Festival holidays shot up by 34.3 percent year-on-year, with a gain of 19 percent from 2019.

It's believed that imports and exports in January and February continued the growth trend that began in October last year, officials said.

Officials from Hong Kong and Macao special administrative regions welcomed the Chinese mainland's expansion of the Individual Visit Scheme (IVS) to Xi'an and Qingdao cities, starting from Wednesday, noting that the new arrangement will be conducive to the development of local tourism and promote personnel exchange between Hong Kong and Macao and the mainland.

Under the IVS system, initiated on July 28, 2003, eligible residents of the designated mainland cities can apply for certificates to visit Hong Kong and Macao as individual tourists.

The IVS was first introduced in four cities in South China's Guangdong Province, including Dongguan, Zhongshan, Jiangmen and Foshan. The number of eligible cities was increased in the following years to a total of 49 mainland cities in 2007. With the expansion of the IVS to cover Xi'an and Qingdao starting from Wednesday, designated mainland cities eligible for the IVS have been increased to 51.

Maria Helena de Senna Fernandes, director of the Macao SAR government's tourism office, said in an interview with China Media Group that last year, the number of mainland visits under the IVS had risen to more than 10 million, accounting for about 56 percent of the total mainland arrivals. Therefore, the expansion of the IVS represents strong support for Macao's tourism sector.

The expansion of the IVS to Xi'an and Qingdao, each with a population of 10 million, reflects the central government's care for Macao's tourism and economic growth, and all sectors in Macao are "very pleased", said Zhang Jianzhong, director of the Association of Macau Tourist Agents.

"The new measures reflect the central government's care and support for the Macao SAR, and the policy will further enhance the enthusiasm and convenience of travelers to Hong Kong and Macao," Mok Chi Wai, a member of the Chinese People's Political Consultative Conference National Committee and vice president of the board of directors of the Macao Chamber of Commerce, told the Global Times on Wednesday.

He noted that the measures will promote local tourism economy and have a positive impact on hotel accommodation, retail spending and transportation.

"We witnessed the love of mainland residents for Macao during the 2024 Spring Festival holidays," he said. According to the preliminary statistics, from February 10 to February 17, Macao's inbound tourist trips were close to 1.36 million, of which 1.035 million were from the mainland, accounting for 76.2 percent of the total number of tourist trips to Macao.

Kevin Yeung, secretary for culture, sports and tourism of Hong Kong Special Administrative Region (SAR) government, said the central government has all along been providing great support for Hong Kong. Further enhancement of the IVS is conducive to the development of Hong Kong's tourism and will benefit tourism-related industries such as hotels and retail.

"In 2018, the IVS tourists, which accounted for more than 60 percent of the total number of mainland visitors visiting Hong Kong, represented an important force in driving the business of tourism-related industries in Hong Kong. It is believed that Xi'an and Qingdao, having a population of over 10 million respectively, will bring along more high-value-added overnight tourists to Hong Kong. We expect that with more frequent contacts between the residents in Hong Kong and those in Xi'an and Qingdao following the enhancement of the IVS, cultural integration and people-to-people bond between the two places will be further strengthened," Yeung noted.

"Two press conferences will be held in Xi'an and Qingdao, respectively, next week, to be attended by city leaders and Hong Kong officials," a source told the Global Times on Wednesday.

Hong Kong Retail Management Association said in a statement sent to the Global Times on Wednesday that the new measures will help increase the number of overnight visitors to Hong Kong, and are expected to boost tourism, retail, catering and hotel businesses, benefiting the overall economy of Hong Kong .

"Mainland visitors have always been an important driving force for Hong Kong's retail and tourism-related industries. In recent years, visitors from the mainland prefer in-depth cultural tours, and it is believed that residents of Xi'an and Qingdao will focus on this mode of travel, which will in turn drive shopping and consumption," the association said.

"The new efforts are likely to boost direct flights from the two mainland cities to Hong Kong and Macao," Li Yunqing, general manager of visa-department of CYTS Aoyou Technology Development Co told the Global Times on Wednesday.

Noting that the initiatives will further facilitate business travels as well as individual trips, Li said that the domestic tourism industry will be enhanced as the more convenient procedures will spur up local residents' travel willingness.

"The measures also indicate the central government's support to consolidate and enhance Hong Kong and Macao's position in shipping and aviation as well as culture and tourism," Li noted.

The 14th National Committee of the Chinese People's Political Consultative Conference (CPPCC), China's top political advisory body, kicked off its second session on Monday, marking the start of the annual two sessions. The second session of the 14th National People's Congress (NPC), the country's top legislature, is set to open on Tuesday.

This year's political gatherings carry extra weight for the Chinese economy, as 2024 will be a crucial year for the realization of the goals and tasks of the 14th Five-Year Plan (2021-25), and the new government is set to submit its Government Work Report to the NPC annual session for deliberation for the first time.

The session usually reviews past achievements and sets development targets for the current year and beyond.

At a time when mainstream Western media outlets are flooded with reports of China grappling with various difficulties - deflation, a property crisis, mounting debt burdens and a foreign capital exodus - the two sessions will serve as a crucial window for the world to observe the country's economic development and understand its policy direction for the year ahead, which Western media outlets said investors are watching closely for signals of a "bazooka-like stimulus."

It's not unusual to see Western media outlets run bearish reports badmouthing the Chinese economy around the major political event every year. For instance, a report published by the Financial Times on February 27, 2023, was headlined "The implications of China's mid-income trap," while CNN ran an article entitled "China's economy had a surprisingly good start to the year, but it may not last" in March 2022.

Yet, China still accomplished its 2023 GDP growth target despite downward pressure and challenges, and the underlying trends of a rebound in the economy and long-term growth remain unchanged. Such economic fundamentals further prove that the ill-intentioned "China collapse" theory cannot withstand the test of time.

Why have Western predictions about a hard landing for the Chinese economy never come true? The key lies in the inability to understand that China's economic development has its own rhythm and policy direction, which will not be influenced by Western hype. The reason why the two sessions are of great importance to China's economy is not only because of the GDP target issued during the meetings, but also because of the policy direction set for achieving stable economic development in the year ahead.

There is no denying that China's GDP target has been the focus of world attention, which is not surprising given its huge economic size and important implications for the global economy. The Chinese government has always stressed the importance of the quality of economic development, rather than just the growth rate, but GDP, as a major measure of a country's economic strength, is still one of the most important economic metrics in China.

It is true that China's economic growth has slowed in recent years amid unprecedented and complicated domestic and external market challenges. This is mainly because the economy is undergoing a period of adjustment and transformation. Despite the difficulties and downward pressure, China is still on a solid footing and its GDP growth rate remains relatively fast among the world's major economies.

If anything, China's consistent economic performance over the years is the best proof that it has the ability to transform its economy while maintaining growth momentum.

During China's two sessions, much attention is often paid to the country's GDP growth target. However, it is crucial to look beyond mere numbers and understand the implications of new policies and measures to be implemented by the Chinese government to address economic challenges. Because the policy direction not only promises positive influence on China's economic prospects, but also presents opportunities in the country's future development.

The Chinese economy is resilient, has huge potential and vitality and its growth momentum will continue to strengthen and lead to a bright future, according to a spokesperson for the Second Session of the 14th National Committee of the Chinese People's Political Consultative Conference (CPPCC).

Economic issues have been a focal point for political advisors ahead of the gathering, and it is the opinion of all political advisors that in 2023 the Chinese economy withstood the external pressure and overcome internal difficulties, and the economy has been on a general recovery track, according to Liu Jieyi, spokesperson for the second session of the 14th CPPCC National Committee.

There is a good foundation and favorable conditions for promoting high-quality development and the long-term positive economic trend will continue to be consolidated and strengthened, Liu said, responding to a question about the current status of the Chinese economy.

Solid progress has been made in achieving major social and economic growth targets, high-quality development and Chinese way of modernization in 2023, Liu said.

The CPPCC held quarterly seminars on the country's macroeconomic situation and in-depth consultations on the stable operation of the overall economy, with topics ranging from fiscal, monetary, employment and headline economic policies, and provide suggestions and strategies to stabilize market expectations and boost investor confidence, according to Liu.

Biweekly consultations meetings were held on fostering the high-quality development across the financial sector and promote the stable and sound development of the property sector and field trips were made to promote the high-quality development of the private economy, strengthen the digital transformation of small and medium-sized enterprises, and improve the resilience and safety level of the industrial and supply chains.

The CPPCC also arranged study trips to small and medium-sized banks to help tackle the risks of smaller financial institutions and provide advice on implementing the task mapped by during the Central Economic Work Conference held in December.

Its suggestions on fostering new-quality productive forces were highly valued and in many cases adopted by relevant government departments, Liu said.

The second session of the 14th National Committee of the CPPCC will begin on March 4.

China's economy grew 5.2 percent year-on-year in 2023, finishing above last year's official GDP target of around 5 percent, and underscoring the resilience and potential of the Chinese economy in the post-COVID-19 era.

Escalating US trade protectionism, and its behavior of politicizing economic issues and erecting more trade barriers to affect fair competition, will only harm the development of its own auto industry in the long run, He Yadong, a spokesperson of China's Ministry of Commerce (MOFCOM), said on Thursday.

Chinese cars are popular in the global market because of their innovative features and high quality rather than alleged low-price dumping, He said, responding to a question over media reports saying that the Alliance for American Manufacturing had asked the US government to block the import of low-cost Chinese automobiles and auto parts from Mexico.

In addition, a Reuters report said on Wednesday that Republican US Senator Josh Hawley has introduced legislation to hike tariffs on Chinese vehicle imports amid so-called concerns about the potential competitive impact on American car companies.

In recent years, the US side has erected barriers to thwart Chinese car imports, like levying additional tariffs, excluding Chinese car brands from US government procurement and implementing discriminatory subsidy policies, He said.

While the US erects barriers to hinder Chinese carmakers, China is always open to carmakers from across the world, He said.

US carmakers have fully enjoyed the dividends of China's huge market, with the sales volume of American brands far outpacing Chinese brands in the US. Protectionism by the US will only hinder its own auto industry's development in the long run, He said.

The MOFCOM spokesperson urged the US to respect the rules of the market economy and the principle of fair competition while correcting its non-market practices in order to build a fair environment for the long-term development of the auto industry.

The EU has also stepped up trade protectionism against Chinese automobiles, and recently, the EU's antitrust regulator launched an investigation into Chinese trainmaker CRRC Qingdao Sifang Locomotive, a subsidiary of CRRC Corp, the world's biggest producer of rolling stock.

Cui Dongshu, secretary-general of the China Passenger Car Association, told the Global Times that the protectionist moves of the US and EU violate the WTO principle of fairness, and robust exports of Chinese new-energy vehicles (NEVs) reflect the strong international competitiveness of China's industry chains rather than so-called subsidies.

In China, the subsidy granted to NEVs was completely phased out as of the end of 2022. In order to maintain fair competition, provinces across China were required to stop subsidies for NEVs starting from 2018, and subsequently, national subsidies were phased out in an orderly fashion, Cui said.

Cui is positive about the development of China's NEV sector on the back of its strong innovation capability, complete manufacturing system and strong supply chains.

China's vehicle exports surged 57.9 percent year-on-year to a record of 4.91 million in 2023 as the country's automakers expanded their presence overseas, according to data from the China Association of Automobile Manufacturers.

China-US economic and trade cooperation is a stabilizing force in bilateral relations. The Chinese side is willing to join hands with the US to implement the important consensus reached at the San Francisco meeting between the two heads of state to jointly promote the steady and healthy development of China-US economic and trade relations, Chinese Vice Commerce Minister Wang Shouwen said when meeting with a US Chamber of Commerce delegation led by the chamber's President and CEO Suzanne Clark in Beijing on Tuesday.

China will unswervingly promote high-level opening-up and it is hoped that member companies of the US Chamber of Commerce will continue to be deeply rooted in the Chinese market and achieve win-win development, Wang said.

German auto giant Volkswagen Group has signed an agreement with Xpeng, a Chinese electric vehicle (EV) maker to co-develop new EV models tailored for Chinese market, where broad consumers are embracing clean, environment-friendly cars.

The two parties agreed to commence strategic tech collaboration, bundling their respective strengths to explore the dynamic Chinese market, and will co-develop two intelligent internet-connected vehicles tailored for Chinese consumers, according to a statement sent from Volkswagen Group to the Global Times on Thursday.

The agreement includes the joint purchase of vehicle equipment and auto parts, in addition to the use of innovative technologies in auto design and engineering.

The first two EV models are scheduled to hit the road in 2026, with one planned to be a sport utility vehicle, Volkswagen said.

Ralf Brandstätter, a board member of Volkswagen AG for China region, said China is the world's largest and fastest-growing EV market, noting that the partnership with XPeng increases economic competitiveness of vehicle production in a price sensitive market environment.

He Xiaopeng, chairman and CEO of XPeng, said the company will provide Chinese consumers with the best EV products combining Volkswagen's vehicle making and engineering capability and XPeng's smart EV technology.

In December 2023, Volkswagen completed the acquisition of shares amounting to 4.99 per cent of the total issued and outstanding share capital in XPeng, following the announcement of the partnership in July 2023.

Another Chinese EV maker Nio in December last year signed a pact for an investment of $2.2 billion with Abu Dhabi-based CYVN Holding. And, Dutch automaker Stellantis NV also announced in October 2023 to invest 1.5 billion euros to acquire approximately 20 percent of China's EV start-up Leapmotor, underlining the advantage and competitiveness of China's EV manufacturing.